It may be surprising to learn that 40% of trading on Toronto Stock Exchange (TSX) and TSX Venture Exchange (TSXV) combined comes from outside of Canada… with a majority coming from the United States (U.S.). For innovative U.S. companies looking to raise growth capital, the Canadian markets can be a gateway to North American capital.

This is especially true today, as U.S. companies listed on TSX and TSXV have experienced a record first half (H1) in 2021.

-

Market Capitalization: U.S. companies listed on TSX & TSXV reached an all-time high combined market capitalization (C$180B), up 62% in the last 10 years.

-

New Listings: 120% increase in new U.S. listings; best H1 for number of new listings on TSX (since 2012) and TSXV (since 2016).

-

Capital Raised: U.S. issuers raised $745M in equity capital; up 50% from H1 2020.

Watch this VIDEO RECAP for U.S. issuers in H1 2021.

For the whole TSX & TSXV market, the H1 2021 is also setting records:

-

Best H1 for capital raised on TSX & TSXV since 2015, with C$34.7B.

-

Best H1 for capital raised in the Technology sector; C$9.6B raised which is more than any other full year.

-

In H1 2021, corporate IPOs on TSX & TSXV were up 1,650% and capital raised was up 113% compared to H1 2020.

-

TSX & TSXV exceeded C$4T in combined market capitalization for the first time in history.

Why Consider a Listing on TSX/TSXV?

1. A Source of Growth Capital

When deciding on a financing path, companies want to know that there is the opportunity for current and ongoing capital raises. Last year, TSX and TSXV issuers raised C$43B, making Canada the 4th largest market in the world for financings… which is impressive considering the size of the Canadian population!

As an alternative to private venture capital, a TSXV listing can provide the benefit of raising small, subsequent rounds of capital. TSXV companies raised C$6.6B in 2020, with an average financing of C$3.5M. And in the first half of 2021, TSXV companies raised C$6.3B, with an average financing of C$5.9M.

These are small public companies doing venture-sized deals. This is why we like to refer to our market as “public venture capital”, as companies are accessing rounds of capital similar to the typical VC route of Series A, B, and C rounds.

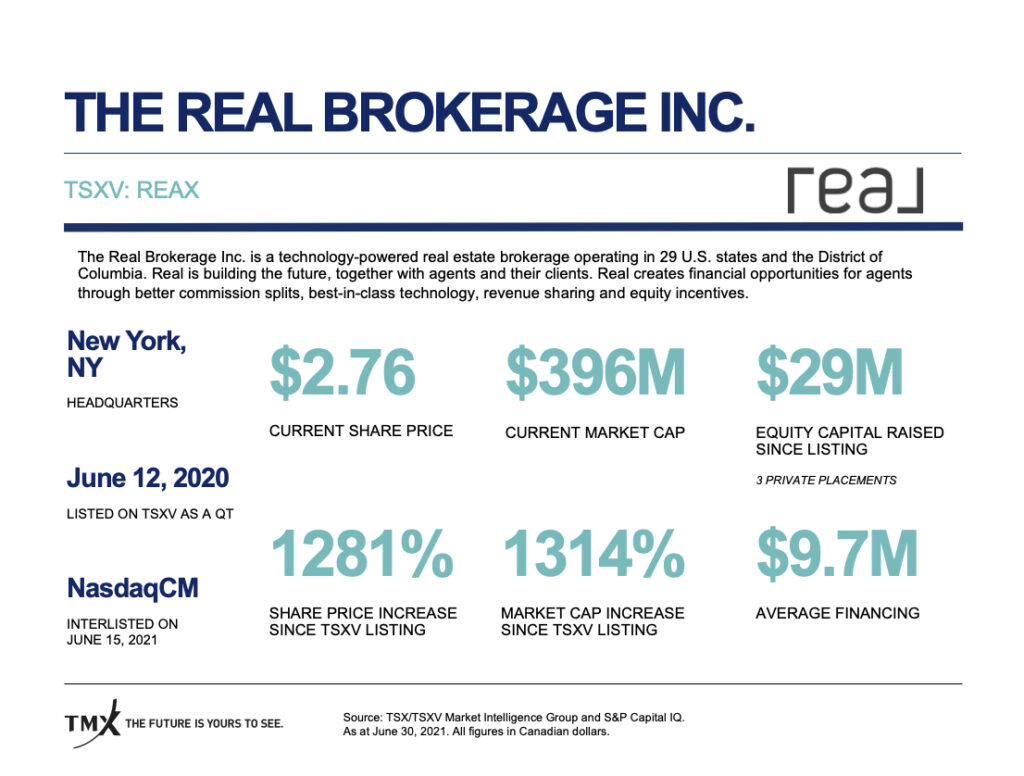

U.S. Highlight: The Real Brokerage Inc. (TSXV:REAX) is based in New York and since its listing in June 2020 the company has raised C$29M in three rounds of financing, and dual-listed on Nasdaq’s Capital Market in June of this year.

2. Tailored to Small Public Companies

With a long history of financing exploration companies, the Canadian public markets have evolved to support small cap public companies of all industries. From the securities commissions, the exchanges and analysts to the retail and institutional investors… the players in the Canadian ecosystem understand and embrace small public companies.

TSXV companies benefit from right-sized corporate governance, ability to raise subsequent rounds of capital, and the opportunity to use public stock as currency for acquisitions. Listing vehicles like the Capital Pool Company (CPC) program allow growth companies to access the public markets without the high costs and risk of a large initial public offering (IPO).

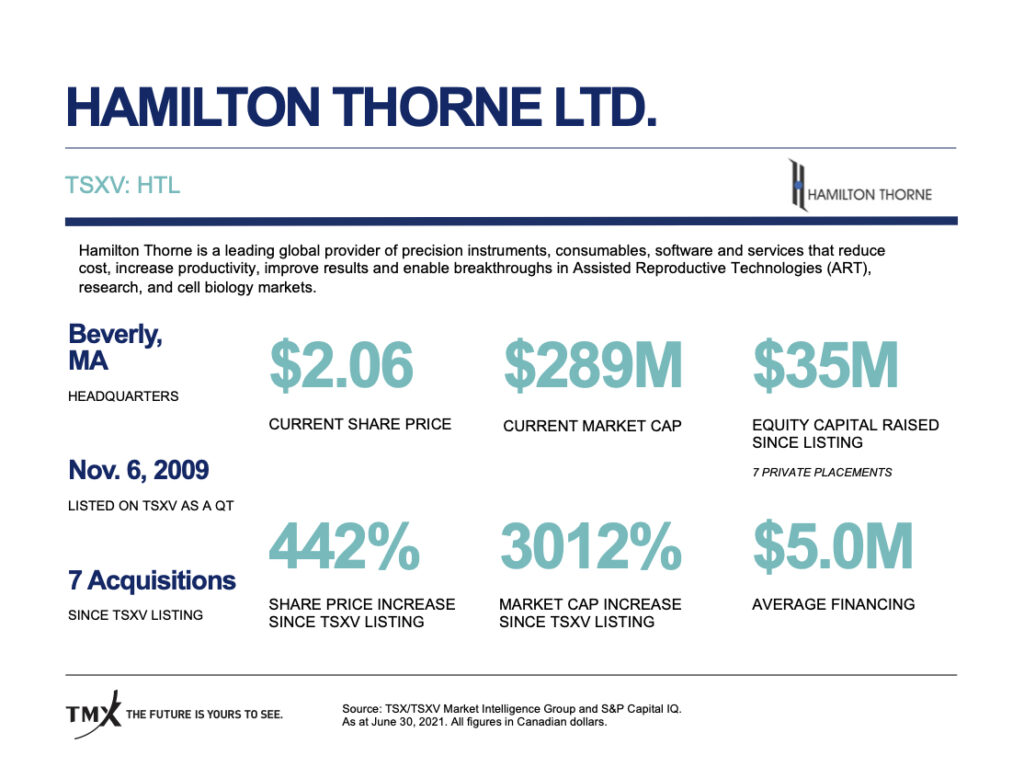

U.S. Highlight: Hamilton Thorne Ltd (TSXV:HTL) has been listed on TSXV for 11 years and continues to use the public markets to fuel its growth completing seven financings (C$35M) and seven acquisitions.

3. No Longer Just a Resource Exchange

While TSX has historically been known as a natural resource market – given our +165 years financing mining and energy companies – today our stock list is quite diverse. In fact, our mining issuers currently account for just 13% of the market cap of all issuers, with other sectors surpassing them.

For the past five years, the number one source of new listings has been innovation companies in tech and life science sectors. Last year, there were 47 new technology/life sciences listings… and the issuers in these sectors raised over C$13B. U.S. innovation companies are also looking north, as in the last five years 56% of new U.S. listings have come from the tech, life sciences and cleantech sectors.

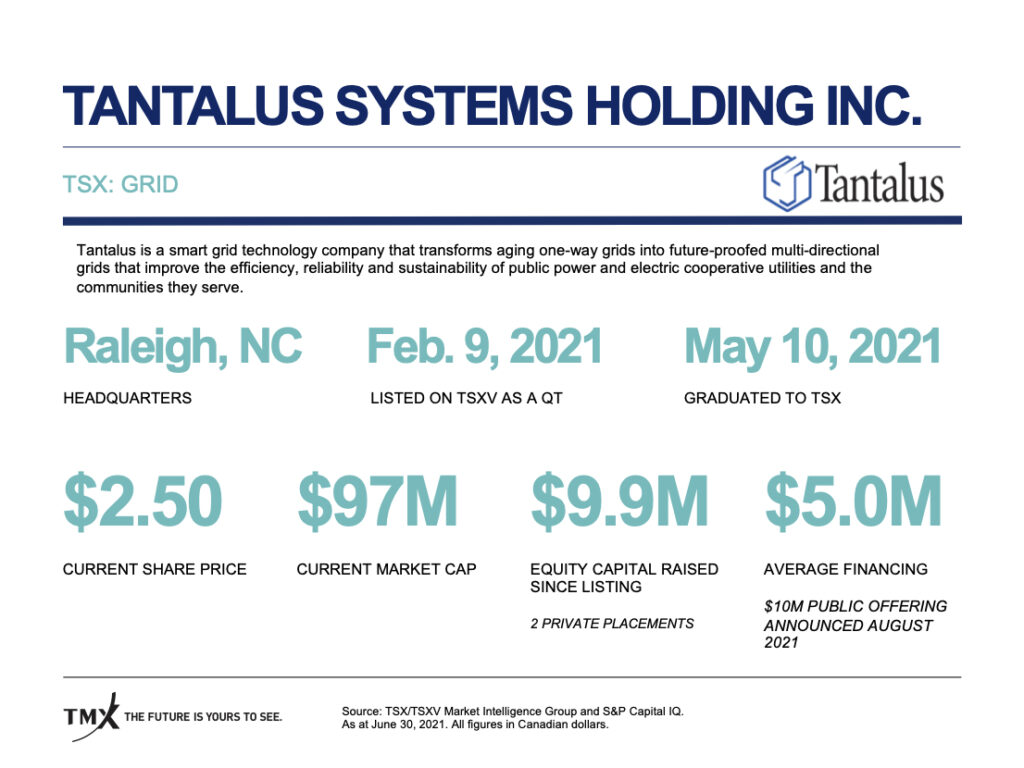

U.S. Highlight: Tantalus Systems Holding Inc. (TSX:GRID) is a smart grid tech company based in Raleigh, NC. The company went public on TSXV in February of this year, raised C$97M in two financings and graduated to the senior board (TSX) three months later.

4. A Platform for Long Term Growth

As Tantalus demonstrated, a key benefit of this two-tiered market is the potential for early stage growth companies to list on TSXV, raise multiple rounds of capital, and when ready, graduate to TSX. In the past 20 years, over 650 companies graduated from the junior board to the senior board, and almost 32% of current TSX-listed technology companies started on TSXV.

TSX is also a true stepping stone to the U.S. markets. Once a TSX issuer is large enough and relevant enough, it can look to interlist on a U.S. stock exchange, and possibly take advantage of the streamlined dual-listing path through the Multi-Jurisdiction Disclosure System (MJDS). If your end goal is to be listed on Nasdaq or NYSE, TSXV and TSX can be part of a viable path to getting there.

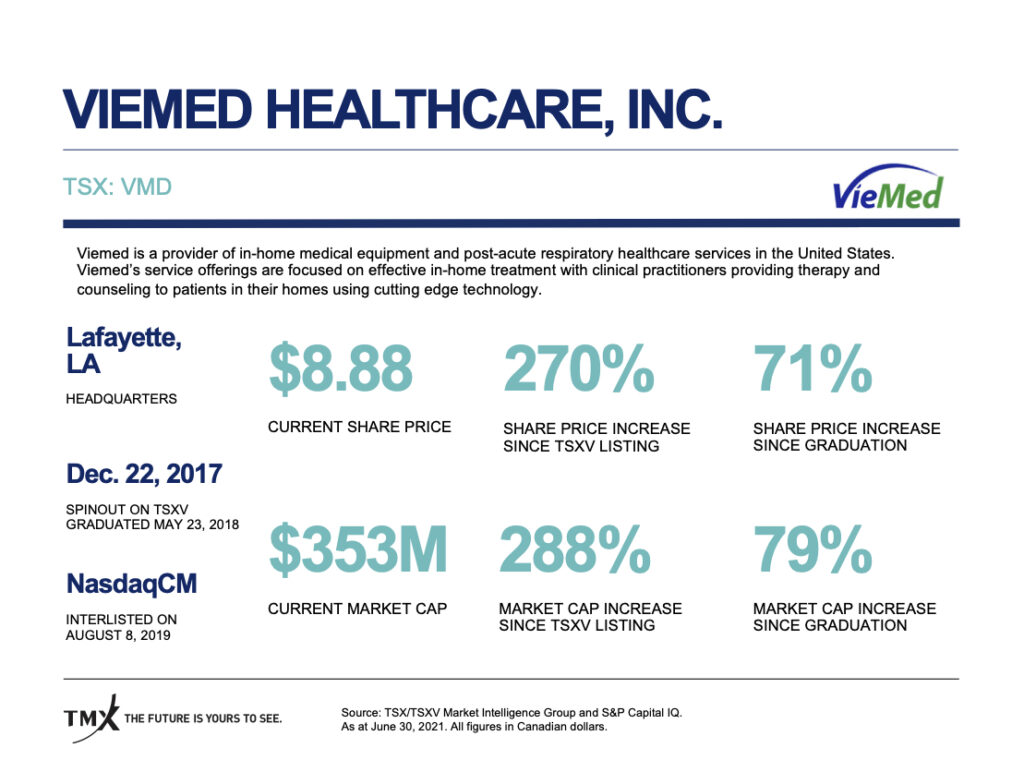

U.S. Highlight: Viemed Healthcare Inc. (TSX:VMD) listed on TSXV in 2017, graduated to TSX a year later, and then dual-listed on Nasdaq a year later in 2019 benefitting from liquidity in two markets.

For the U.S. growth company that is looking to build a long-term sustainable business that requires ongoing access to capital with an end goal of eventually dual-listing on a U.S. exchange, TSX and TSXV are important financing options to consider.

For more information, contact Delilah Panio, VP of US Capital Formation, at delilah.panio@tmx.com or visit us.tsx.com.

Related: Catch up on part one of this series, Public Venture Capital: An Alternative Financing Option for U.S. Growth Companies; and part two: Going Public Considerations: A Checklist for U.S. Companies.

* Unless otherwise noted, all data is sourced from the Market Intelligence Group of TMX Group as of June 30, 2021.

Copyright © 2021 TSX Inc. All rights reserved. Do not copy, distribute, sell or modify this document without TSX Inc.’s prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this article, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This article is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities listed on Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. Capital Pool Company, CPC, TMX, the TMX design, TMX Group, Toronto Stock Exchange, TSX, TSX Venture Exchange, TSXV, The Future is Yours to See., and Voir le futur. Réaliser l’avenir. are the trademarks of TSX Inc. All other trademarks used in this article are the property of their respective owners.